Defining the Budget

Wed, Apr 17, 2019I’ve struggled putting together a realistic budget for this build. There is still so much that is variable, it’s hard to lock things down and know where we stand. Given what we’ve learned over the last few weeks, we are probably back to doing the foundation ourselves, which means going with ICF (material costs going up, but labor costs going way down). I will explain those details in another article, but that’s just one example of how much is changing with the budget.

The budget used to be a critically import part of our project documentation.

Until recently, we were planning to finance the construction costs with a construction loan. In order to do that, we need to know the exact cost of the build with a low margin of error. The bank won’t give us more money later on and financing such a loan would eat up most of my cash on hand. The deal breaker was that the build has to be completed (with final certificate of occupancy in hand) within 12 months of the loan being issued. With wanting to do most of the work ourselves, the timeline isn’t feasible, so the loan just isn’t feasible.

If we are not going to get a construction loan, what we need to focus on is securing enough money to fund the project through exterior finishes within 14 months (an HOA requirement). In other words, we need to have funds for the foundation, framing, roof, rough plumbing, HVAC, fire sprinklers, and exterior finishes. The remaining interior finishes can be completed at a slower pace, and as funds become available. We don’t want this project to go on forever, but the point is that after a certain step, the budget can be a bit more fuzzy.

Organizing our Budget

We are using a shared Google Sheets spreadsheet to manage the budget. The primary tab aggregates and organizes all the itemized expenses from the various other tab, which are grouped by component (e.g., foundation, framing/lumber, windows, kitchen, etc). This allows us to get a quick high level view of where our costs are, and then dive into the specific tab to see the details.

The master tab includes a ‘Percent of Budget’ column. This tells us what percent of the total budget each line item attributes for. This is a good way to see where we should spend our time optimizing cost.

At the bottom of the master tab is our totals. This is where things get interesting. I am currently projecting a construction cost of $420,000, but with tax and a small contingency budget, that is bringing our construction costs to around $500,000. That’s a lot for having to do so much of the work ourselves! And it doesn’t include the cost of the land.

$500,000 seems like a lot until we consider the price per square foot. At the time of this writing, modestly finished similar sized homes are going for about $200 per square foot, but those do not have a view of the water, nor are they on a lot as large as ours. We were told when we were doing our research that we should expect to pay about $220/sqft at a minimum, and more likely $280/sqft. Our budget currently puts us at $135/sqft. I think we have some more things to account for, but I’d be surprised if it goes above $150/sqft. Keep in mind that includes a fairly generous contingency fund too.

Maintaining our Budget

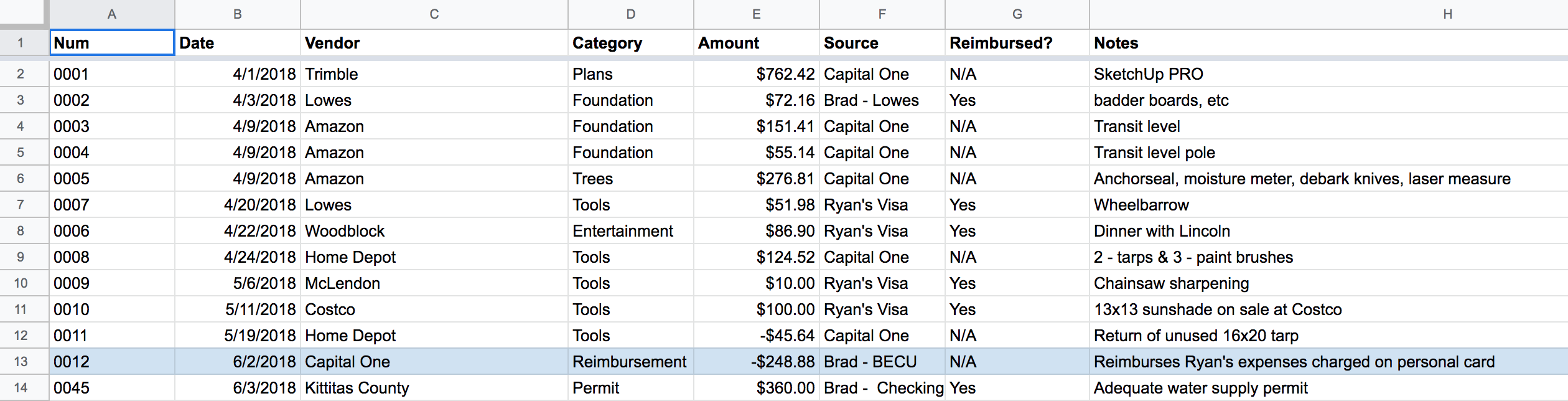

In addition to having a good projection of what our budget should look like, I want to keep a detailed log that tracks our actual expenses. For this, we’re keeping a separate spreadsheet that we call our Expense Log. This spreadsheet tracks the date, vendor, cost, and category. From this data, we can generate a pivot table totalling the costs in each category. I manually sync this back to the ‘actual’ column of our budget.

Each of the items in the expense log is also given an ID number, and this becomes the file name of the receipt image. For example, 0001 corresponds to image 0001.jpg on our shared drive.

We expect this project will drag on for a couple of years, so keeping all this information is important to track the expenses of the project over time.

Next Post > > < < Previous Post